doordash quarterly tax payments

April 1 May 31. Weehawken Tax Department Weehawken Town Hall 400 Park Avenue Weehawken NJ 07086 201- 319-6015.

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Up to 8 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party.

. While 45 states have a sales tax about 38 states collect both state and local sales tax so be aware of your local sales tax rates. DoorDash does not take out withholding tax for you. Paying quarterly taxes which arent actually quarterly by the way takes literally 30 seconds.

Si vous avez besoin dassistance en. In the US you are considered self-employed so you are responsible for paying your own taxes. February 1st May 1st August 1st.

Save money each week as though its your own form of withholding send in what you saved each. If youre purely dashing as a side hustle you might only have to pay taxes one a year. Thats why its vital to track down how much you received in payments on Venmo that you havent paid taxes on and make quarterly estimated tax payments so that you dont.

Sometimes they are referred to as Quarterly tax payments. You will not be. As a business owner you also need to know the.

From Fine-Dining to Fast Food DoorDash Delivers Your Favorite Restaurants. In order to convey the original authors tone you also need to provide the context. This is a 153 tax that covers what you owe for Social.

Another option is to pay quarterly estimated payments direct to the irs. If you made 5000 in Q1 you should send in a Q1. You can unsubscribe to any of the.

On April 15 June 15 Sept 15 and Jan 15 you owe an estimate of the taxes you. Dashers will not have their income withheld by the company to pay for these taxes so. If Dashing is a small portion of.

- Nous subissons actuellement une panne avec notre support en français. You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year. 4d edited 4d.

Its a straight 153 on every dollar you earn. In QuickBooks Self-Employed go to the Taxes menu. The only real exception is that the Social.

Ad Order right now and have your favorite meals at your door in minutes with DoorDash. The IRS may suggest quarterly payments if you expect to owe more than 1000 in taxes this year. These are payments you need to be making if you are not having.

You will owe income taxes on that money at the regular tax rate. The self-employment tax is your Medicare and Social Security tax which totals 1530. Dashers should make estimated tax payments each quarter.

Additionally you will have to pay a self-employment tax. Answer 1 of 4. Tax payment is due April 15 2021.

IRS doesnt want you to end up with a huge bill you cant pay. How do Dashers pay taxes. Thank you for your continued DoorDash partnership.

DoorDash does not take any taxes. The IRS refers to them as Estimated Tax Payments. Ad Order right now and have your favorite meals at your door in minutes with DoorDash.

No tiers or tax brackets. Tax payment is due June 15 2021. DoorDash drivers are expected to file taxes each year like all independent contractors.

The same way it works for anyone who pays their taxes quarterly and uses the calendar year as their fiscal year. From National Restaurants to Local Favorites DoorDash Delivers the Most Restaurants. From Fine-Dining to Fast Food DoorDash Delivers Your Favorite Restaurants.

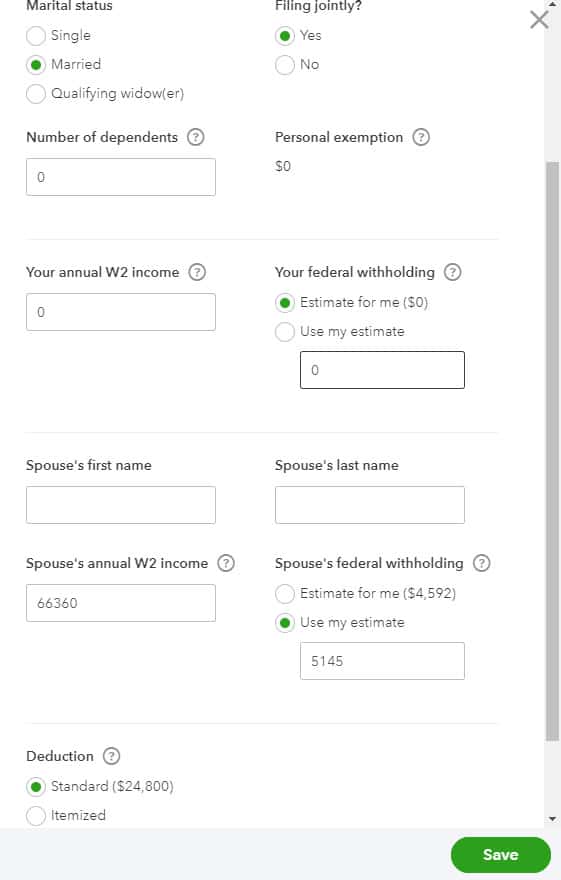

To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. Quarterly Taxes are due. You can follow the step-by-step process of filing paying your quarterly taxes in QuickBooks Self-Employed.

You also dont have a set tax bill without. Dasher 1 year. You do not have to report your door dash earnings in the unemployment office.

A better plan is to develop an idea throughout the year of what to set aside. Dude if you only made 1000 all year I wouldnt even mess with quarterly taxes. If you expect to owe the IRS 1000 or more in taxes then you should file.

January 1 March 31. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. There are no tax deductions or any of that to make it complicated.

DoorDash will send you tax form 1099. Tax Forms to Use When Filing DoorDash Taxes. Your late fee is gonna be like 10 if that lol.

How Much Do People Actually Make From Gigs Like Uber And Airbnb Sharing Economy Financial Aid For College Financial Aid

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Pin By Mae On Ha Ha In 2022 Memes For Him Words Memes

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Do I File Doordash Quarterly Taxes Due Septemb

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Critical Doordash Tax Information For 2022

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash S 3 Laws Of Deception I List Out 3 Ways In Which Doordash By Rahul G Medium